Case Note & Summary

The High Court set aside the adjudication order made by the Deputy Commissioner of State Tax on the grounds of failure to provide reasons and lack of compliance with principles of natural justice. The order was found to be a non-speaking order, containing mere conclusions without addressing the petitioner’s detailed response. The matter is remanded for fresh adjudication, directing the Respondent to issue a reasoned and speaking order.

Hearing of the CaseThe counsel for both parties was heard, and the Rule was made returnable immediately with mutual consent.

Challenge Raised by the PetitionerThe petitioner challenged (i) the adjudication order dated 03 July 2023 by the Deputy Commissioner of State Tax, Pune, and (ii) the order dated 06 July 2022 blocking the petitioner's credit ledger.

Abandoned Challenge and Focus on Adjudication OrderThe petitioner withdrew the challenge against the show-cause notice dated 04 August 2022 and accepted that the issue regarding the credit ledger had been resolved, focusing only on the adjudication order dated 03 July 2023.

Petitioner's Response to Show Cause NoticeThe petitioner had submitted a detailed response on 21 February 2023, but the issue of whether a personal hearing was granted remains disputed.

Lack of Reasoning in the Impugned OrderThe impugned order lacks detailed reasoning under the "Discussions and Findings" section, merely stating conclusions without addressing the petitioner’s response.

Principle of Natural JusticeFailure to provide reasons violates the principles of natural justice and fair play, making it difficult for an appellate authority to understand the decision's basis.

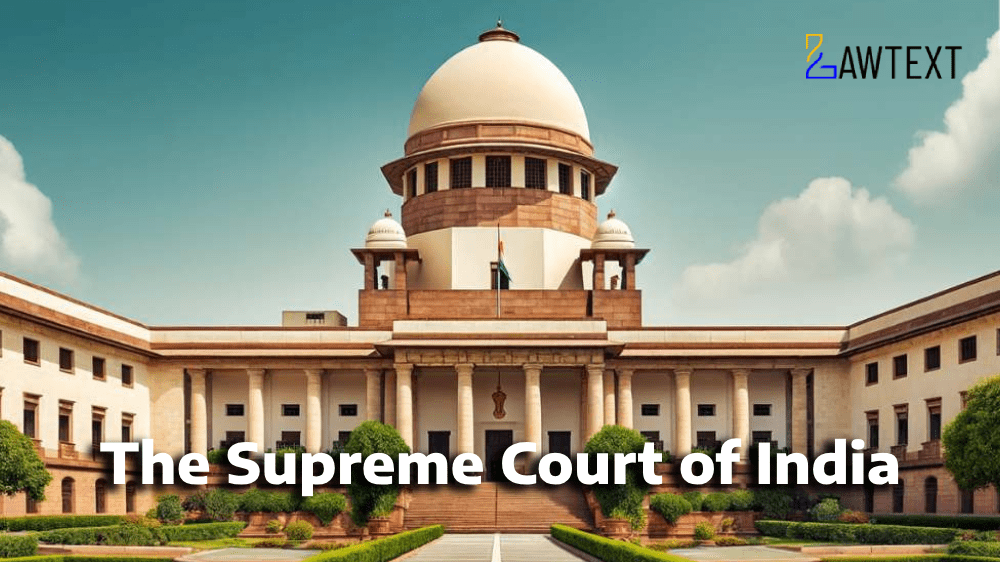

Necessity of Reasoned OrdersCiting the Supreme Court's decision in Cyril Lasrado (Dead) by Lrs and Others vs. Juliana Maria Lasrado, the Court emphasized that unreasoned orders fail the standard of justice.

Findings on the Impugned OrderThe Court concluded that the impugned order is a non-speaking one, containing mere ipse dixit statements without independent reasons, rendering it unsustainable.

Setting Aside and RemandThe impugned order dated 03 July 2023 was set aside. The Court remanded the matter for fresh adjudication with an order to hear the petitioner and issue a reasoned, speaking order within six weeks.

Rule Made AbsoluteThe Rule was made absolute with no order as to costs.

Implementation of the OrderDirections were given to act upon the authenticated copy of this order.

Acts and Sections Discussed The Goods and Services Tax Act, 2017 Section 73: Relates to the determination of tax not paid or short paid due to reasons other than fraud, suppression, or willful misstatement. Ratio DecidendiAn order issued by a quasi-judicial authority must provide clear reasons and address the contentions raised by the parties. The absence of reasons constitutes a violation of natural justice and renders the right to appeal ineffective. Therefore, a non-speaking order is unsustainable and must be set aside.

Subjects:Adjudication in Tax Disputes, Principles of Natural Justice

GST, Adjudication Order, Natural Justice, Speaking Order, Section 73 of GST Act, Tax Appeal

Premium Content

The Case Note & Summary is only available to subscribed members.

Subscribe Now to access detailed case analysis

Issue of Consideration: Bhansali Industries Versus Union of India & Ors.

Premium Content

The Issue of Consideration is only available to subscribed members.

Subscribe Now to access critical case issues